Affiliated Broker-Dealer (“BD”) company

Oakwood Capital Securities, Inc. (“OCS”) was formed in 1987 as an introducing broker-dealer (BD) that offers a variety of securities and fixed income solutions. Committed to helping people pursue their financial goals and dreams.

All our financial consultants are independent contractors offering a wide range of financial products and services to individuals and business owners. Similar to Oakwood Capital, Inc., OCS does not offer proprietary products and services.

Custody & Clearing Partners

RBC Custody and Clearing & Charles Schwab

RBC Custody & Clearing is one of the world’s largest providers of financial and brokerage services offering comprehensive clearing, custody and execution services to a variety of broker-dealers, such as Oakwood Capital Securities, Inc. Charles provides a full range of brokerage, banking and financial advisory services through its operating partners such as Oakwood Capital, Inc. Offering investors a contemporary, full-service approach to build and manage their investments, providing investment-related products, services, and sophisticated financial planning that combine the best of what people and technology have to offer.

As custodian of your account(s), RBC Custody & Clearing, as well as Charles Schwab at the direction of Oakwood Capital, Inc., is responsible for:

- The execution, clearance, and settlement of securities transactions

- The preparation and delivery of transaction confirmations and account statements

- The custody (or safekeeping), receipt, and delivery of cash, funds and securities

-

Steps RBC CM (RBC) Takes to Protect Your Assets

-

In today’s rapidly changing financial markets, you want to entrust your investments to a strong, trusted organization. Our firm has selected RBC Clearing & Custody, a division of RBC Capital Markets, LLC (RBC), to provide transactional support, record keeping, and other services related to maintaining your accounts. RBC views the safety and security of the assets in your accounts as a priority equal in importance to the work our firm does to help you build, preserve, enjoy, and share your wealth.

The assets held in an account at RBC have four layers of protection:

- The fiscal stewardship of RBC

- Compliance with Securities and Exchange Commission (SEC) requirements

- Securities Investor Protection Corporation (SIPC) insurance

- An additional insurance policy purchased from Lloyd’s of London

First layer of protection: Fiscal Stewardship

RBC is known for careful, fiscally conscious decision making that benefits our clients and firm as a whole.

One of the world’s leading diversified financial services companies, providing personal and commercial banking, wealth management services, insurance, corporate and investment banking, and transaction processing services on a global basis.

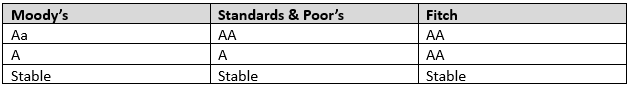

Royal Bank of Canada— consistently high credit ratings

Second layer of protection: compliance with SEC requirements

Segregation of Assets

Segregation simply means your assets are kept separate from firm assets, and thus are protected from potential losses of the firm.

Capital Requirements

RBC also fully complies with SEC rules requiring all broker-dealer firms to maintain sufficient net capital to help confirm that you will get your cash and securities back, in the unlikely event that a firm should fail.

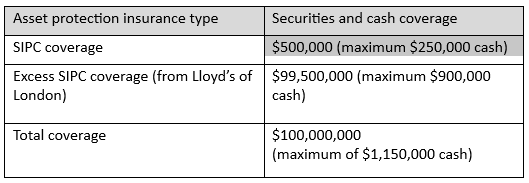

Third layer of protection: SIPC insurance

Since RBC is a member of SIPC—a nonprofit corporation funded by member securities broker-dealers—you are eligible for SIPC insurance protection. In the rare event that RBC would become insolvent and by some unlikely sequence there were securities missing from your account, SIPC reserve funds would be available to satisfy your claims against the firm, up to $500,000 per client, including up to $250,000 in cash. All client accounts which are similarly titled are combined for purposes of determining SIPC protection and each separate legal title would be entitled to the full SIPC protection, as long as SIPC does not determine that the accounts are titled that way in order to avoid the SIPC limit.

Shares of money market funds, although often thought of by investors as cash, are, in fact, securities. If you hold such securities in your account, these shares are protected in the same manner as any other covered security and are not included in the $250,000 cash threshold.

For more information about SIPC coverage, please see the SIPC website at www.sipc.org.

Fourth layer of protection: excess SIPC protection

Another way clients’ assets are protected is through an insurance policy purchased by RBC from Lloyd’s of London that provides coverage in excess of SIPC.

This additional policy covers up to $99.5 million per SIPC-qualified account (of which $900,000 may be cash), subject to a total maximum aggregate for RBC of $400 million that would be distributed on a pro-rata basis across all losses by clients of RBC.

There has never been a claim paid by an excess SIPC carrier. This is due in part to the segregation rules and the existence of SIPC coverage, which are the first lines of defense in the event of a brokerage firm failure. Excess SIPC insurance is an additional layer of coverage in place for the statistically small chance that SIPC coverage would not be sufficient to settle claims.

The table below illustrates layers three and four: the types of asset protection insurance available, the coverage you can expect to receive, and their total value together.

Investment and insurance products offered through RBC Wealth Management are not insured by the FDIC or any other federal government agency, are not deposits or other obligations of, or guaranteed by, a bank or any bank affiliate, and are subject to investment risks, including possible loss of the principal amount invested.

-

How Your Assets are Protected at Schwab

-

We work hard to make Schwab a secure and safe place for your money. Whether you hold securities like stocks, bonds, mutual funds, exchange traded funds, or money market funds in a Schwab brokerage account, or cash deposits in a Schwab Bank account, we have your assets protected. Here are answers to the most common questions about all the ways Schwab works to keep your money safe.

How are my securities at Schwab protected?

The first thing to remember is your securities—like stocks, bonds, mutual funds, exchange traded funds, or money market funds—held at Schwab are yours. The SEC's Customer Protection Rule safeguards customer assets at brokerage firms by preventing firms from using customer assets to finance their own proprietary businesses.

At Schwab, clients' fully paid securities are segregated from other firm assets and held at third party depository institutions and custodians such as the Depository Trust Company and Bank of New York. There are reporting and auditing requirements in place by government regulators to help ensure all broker-dealers comply with this rule. In the very unlikely event that Schwab should become insolvent, these segregated securities are not available to general creditors and are protected against creditors' claims.

What part of my assets are protected by FDIC?

The Federal Deposit Insurance Corporation (FDIC) is an independent agency that maintains the Deposit Insurance Fund which is backed by the full faith and credit of the United States government. Its purpose is to protect depositors' funds placed in banks and savings associations.

The FDIC insures accounts held at member banks up to $250,000 per depositor, per insured bank, based on ownership category. However, all deposits held at the same FDIC-insured bank in the same ownership capacity are added together to determine your total amount of FDIC insurance coverage at that bank. This rule applies whether you open an account directly at the bank (such as a Schwab Bank Investor Checking™ or Schwab Bank Investor Savings account™), or whether Schwab brokerage holds the accounts on your behalf (such as through Schwab's Bank Sweep feature). Bank Sweep deposits may be swept into more than one Program Bank to extend the total FDIC coverage available to you.

CDs in Schwab's CD marketplace, Schwab CD OneSource®, are also protected by the FDIC. CDs you purchase through Schwab are aggregated with other deposits you hold at each issuing institution and are FDIC-insured up to $250,000 per bank.

What is SIPC coverage and when does it become activated?

Schwab is a member of Securities Investor Protection Corporation (SIPC), which provides protection for securities and cash in client brokerage accounts, including those held by clients of investment advisors with Schwab Advisor Services. SIPC protections are activated in the rare event that the broker-dealer fails (bankruptcy) and client assets are missing due to fraud or other causes.

According to SIPC, most broker-dealer failures happen with no securities missing. Since their inception over 50 years ago, 99% of eligible investors got their investments back in the failed brokerage firms cases that it has handled. The SIPC liquidation process generally assures that customers of a failed broker-dealer receive their securities and cash with reasonable promptness after filing a claim.

How does SIPC coverage work?

SIPC protects against the loss of cash and securities—such as stocks and bonds—held by a customer at a SIPC-member brokerage firm. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash. There is no requirement that a customer reside in or be a citizen of the United States. A non-U.S. citizen with a Schwab account is treated the same as a resident or citizen of the United States with a Schwab account.

SIPC coverage is used to reimburse customers if there is a shortage after all customer assets held at the brokerage firm have been recovered. SIPC provides up to $500,000 of protection for brokerage accounts held in each separate capacity (e.g., joint tenant or sole owner), with a limit of $250,000 for claims of uninvested cash balances. These limits do not mean that the account will only receive up to $500,000 of their invested securities. Rather, in a SIPC customer proceeding, the account will receive a pro-rata share of all client assets recovered in liquidation then will receive up to $500,000 from SIPC to make up any difference that exists. SIPC does not protect against the decline in value of customer securities.

Does Schwab have any additional protections for client securities beyond those provided by SIPC?

Yes, in addition to SIPC, Schwab clients receive an extra level of coverage through "excess SIPC" insurance protection for securities and cash. This helps ensure claims will be covered in the event of a brokerage firm failure and funds covered by SIPC protections are exhausted. Schwab's Excess SIPC program has a $600 million aggregate (meaning the most the program will pay for the Excess SIPC portion of the losses). Commodity interests, futures contracts and cash in futures accounts are not protected by SIPC.